How Will SVB Fallout Impact Southeast Asian Startups and VCs?

How Will SVB Fallout Impact Southeast Asian Startups and VCs?

Recommended

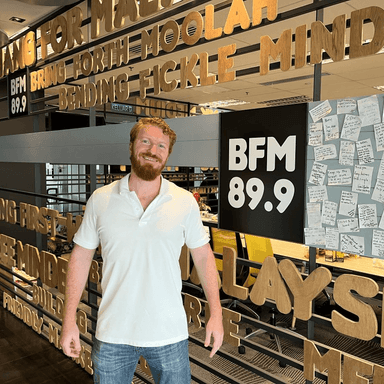

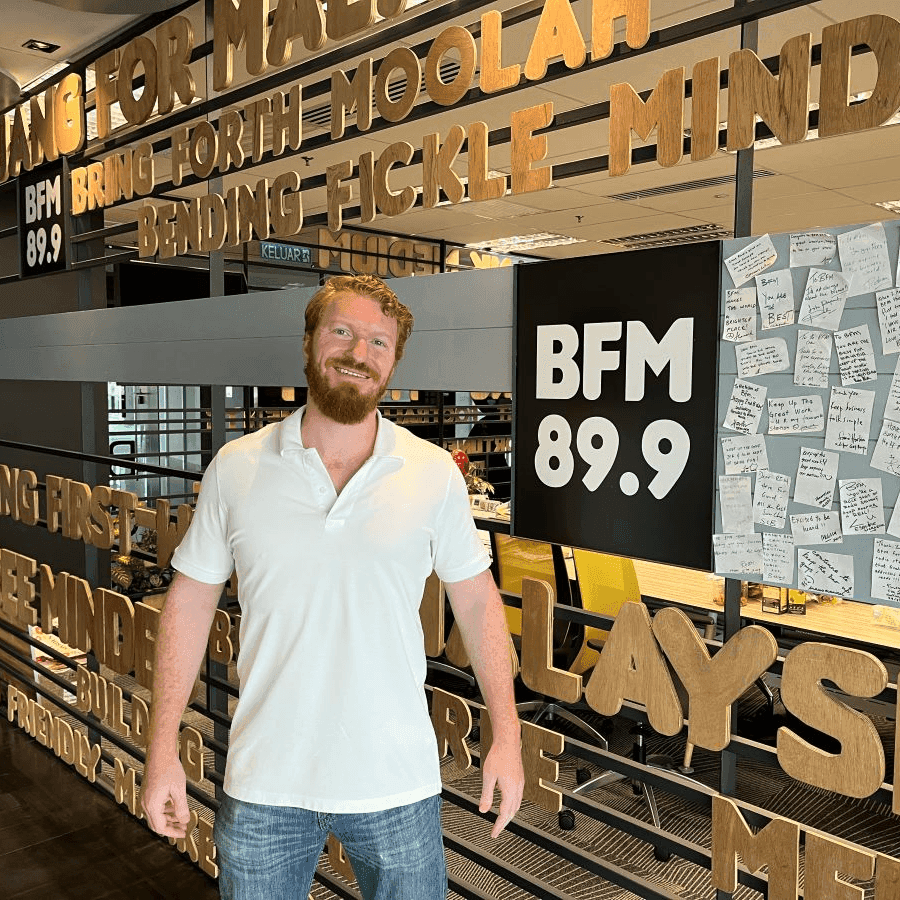

Guest: Kevin Brockland (Founder & Managing Partner), Indelible Ventures

Today on BizBytes we explore the potential impact that SVB’s collapse could have on the Southeast Asian startup ecosystem with Kevin Brockland, Founder and Managing Partner of Indelible Ventures - a VC that targets seed stage, tech-enabled B2B startups in the region.

It’s been just over a week since US federal regulators stepped in to take over Silicon Valley Bank (SVB) - but the effects are still surfacing. SVB’s fall has caused an overall unease in the startup ecosystem, but has had other domino effects, from hitting bank stocks to setting off a political blame-game in the US.

Bank failures like this have happened before, Investopedia notes that there were more than 550 banks shut down between 2001 and the start of 2023. But this one was particularly newsworthy - because the abrupt fall of the $212 billion bank has triggered the most significant financial crisis in over a decade as it is the largest bank to fail since Washington Mutual closed its doors amid the financial crisis of 2008.

However, if you want to learn more about what led us here and the key developments to watch out for, The Morning Run dove into this a week ago on the podcast ‘SVB Collapse Sign Of Fed's Blindspot’.

Other related shows on BFM:

Presenter: Roshan Kanesan, Lily Chai

Producer: Roshan Kanesan

Share:

Recommended

Recent episodes

0

Latest stories

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved